Over 80% of all stock market trading transactions performed in the US are executed thanks to algorithmic trading, designed specifically to trade with minimal human intervention.

In a world where computer codes are written to perform a perpetual range of functions vital to human routine, trade and commerce are no exception. In the wake of an increase in the frequency of financial trading and in the intensity of the processes involved, computerization of order flows in the financial market became inevitable by, as early as the 1970s. Ranging from lines of code that helped the market specialist in determining the market clearing opening price to a program that traders can train to trade in a specific manner, a well programmed trading algorithm can do almost all functions on its own.

Defining Algorithmic Trading

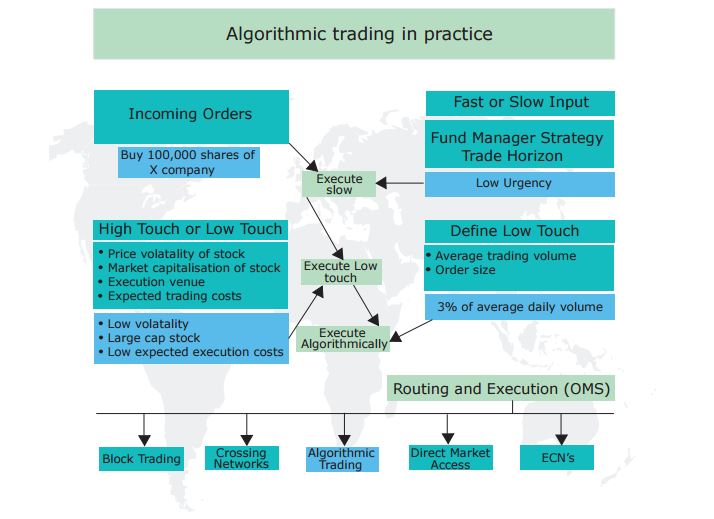

Algorithmic Trading is basically a systematic process of trading that facilitates transactional decision making in finance, using advanced mathematical tools. To define it by the book, it can be construed as, “placing a buy or sell order of a defined quantity into a quantitative model that automatically generates the timing of orders and the size of orders based on goals specified by the parameters and constraints of the algorithm”. The constraints or rules are built into the quantitative model to determine the optimal time for an order to be placed with the least impact on the price of the financial tool. Algorithms in the trading scenario thus codify a trader’s execution strategy, trims on excessive transaction costs and enables fund managers to control their own trading processes.

How does Algo-trading work?

Also known as black-box trading or automated trading, algo-trading uses computer-logic and complex mathematical formulae that are trained to make high speed transactions and decisions in the financial market, on the basis of the rules that determine timing, price, quantity and other operational parameters. Let us consider an example of how a trader can use rules to instruct an algorithm to trade optimally. Given are two rules as below:

- Buy 150 shares of a particular stock when its 80-day moving average rises above its 150-day moving average

- Sell shares of the stock when its 80-day moving average drops below its 150-day moving average

The two instructions can be used to write a computer code that shall monitor the moving average indicators of the stock and its price. When the conditions are met, the buy and sell orders can be placed automatically. This saves the trader the time and effort. It eliminates the need to manually monitor the stocks as the algorithm identifies the correct opportunities. Besides marking out profit opportunities for the trader, this system of black-box trading makes markets more liquid and organizes trading systematically, by ruling out emotional human impacts and any other ambiguities on trading activities. Moreover, it reduces transactions costs, scope of manual errors and time consumed. Since algo-trading constantly monitors trade and financial fluctuations, it can avoid significant price change and also automatically checks multiple market conditions at a given instant. The algorithm is back tested based on historical and real-time data thus minimizing erraticism.

Black-box Trading Strategies

Algorithmic trading can most commonly be seen employed by large institutional investors as they need to purchase large amount of shares every day. Meticulously designed complex algorithms ensure that these investors obtain the best possible price without compromising on the stock’s price and increasing purchasing costs. Some of the popular strategies that they employ include:

- Trend following: Algorithms monitor general trends in the financial market data using historical and real-time prices. They then calculate profits, margins and losses using these trends to arrive to the most optimal decision.

- News reading: As the name suggests, strategies under algorithmic trading are specially designed to employ text analytics and advanced codes to scan the news for global incidents that could affect market behavior and prescript the most beneficial investment options.

- Iceberging: Iceberging is a cost reduction strategy that masks large orders by splitting them into smaller orders spread over a long period of time. Iceberging is also known as Volume Weighted Average Price (VWAP) or Time Weighted Average Price (TWAP), depending on the scale used to split the assets. Stealth strategies on the other hand uncover these iceberged orders.

- Arbitrage: Arbitrage is computed by calculating the difference between the market prices of two different entities. Commonly practiced in global businesses, companies use the concept of arbitrage to cut costs and maximize profits. We could take the instance of companies comparing the costs of raw material or labor procurement from other countries as an example. High-speed algorithmic trading can track the price differences and throw the most profitable option as an output.

- Scalping: A scalper trades in equities, options or the futures market and holds his position for a very short period of time. This is done to extract profit from the bid-ask spread of an asset. Since price movements must be less than the security’s spread, trading decisions in such scenarios need to happen within fractions of minutes. To make significant profits on small price changes, one needs to compound several transactions with a strict exit strategy to prevent losses. Algorithms designed to perform scalping can efficiently do that without human intervention.

- Trading before Index Fund Rebalancing: Mutual funds are a popular investment strategies, the index funds of which are regularly adjusted to match the new prices of the funds’ underlying assets. Preprogrammed trading rules can monitor these adjustments in advance and thus transfer profits from investors to algorithmic traders.

- Mean Reversion: The mathematical tool, Mean reversion, calculates the average of a security’s temporary high and low prices. This is used by algorithms in trading to further compute the potential profit from the movement of the security’s price as it deviates from the mean price.

There are many other algorithms and strategies that make algorithmic transactions a successful venture. In a nutshell, automated trading can be seen in multiple forms of investment activities and transactions viz. (i) Mid to long term investors or buy-side firms where they are used to purchase stocks in large quantities without affecting stock prices, (ii) Short term and sell-side traders who expect liquidity in trade execution and (iii) systematic traders who resort on algorithms for following trends and investing in hedge funds amongst other activities.

Creating Trading Algorithms

Creating algorithms for trading is a systematic and intelligent process that is carried out in stages. Time frame and constraints form an integral part of the prerequisite human oversight that is needed for smooth functioning of these lines of code. The first stage in creating trading algorithms is defining these constraints. These include market constraints (for instance, liquidity), financial constraints (profit potential, margins etc.) and even adjustable frequency and operation time period of these algorithms to accommodate a variety of participant needs. The next step is to develop a strategy. Rule based strategies can easily be coded to trade, keeping in mind the entries, stop losses and price targets based on quantifiable data or price movements. this is followed by stringently testing the code under various scenarios. Continual maintenance and monitoring is required for a fail-proof implementation.

Algorithmic trading: a boon or a bane?

An obvious question that algorithmic trading raises is one on the identity of the traders. Black-box trading can hide the identity of the participants and prevent speculations. This lack of transparency can hence facilitate illegal activities. On the other hand, speculators well trained to penetrate through the fabric of algorithmic trading, can looks for patterns and weaknesses of traders and create baits to wrongfully cheat on them. Despite a few flaws, automated trading is a high-frequency service that enables traders to make good investment and trading decisions.