Insurance is an old player in the market. The industry has expanded into a multibillion-dollar business across the globe. With the increase in awareness among the masses, the insurance sector has consistently witnessed exponential growth for quite a while. But there has been next to little technological advancement to accompany this expansion.

After years of working with the same old framework, the insurance sector is now undergoing a landmark change – we’re seeing insurtech companies spring up. Similar to how the fianance industry had thousands of fintech companies take over and then some, insurance is not an exception anymore either. Insurance Tech companies have already disrupted market segments with their tech-fueled business models and big investments.

#1 – What is Insurance Tech?

- The insurance landscape has witnessed minimal technological innovation over the course of so many years. Insurance Tech companies are bringing about a change in this scenario.

- Insurtech is a consolidation of insurance and modern technologies, like telematics, Internet of Things, big data, blockchain, artificial intelligence and more. Its primary purpose is to eliminate the complications involved in the current process of insurance by leveraging innovative digital means for meeting customer needs.

- From the most basic healthcare insurance to the rather arduous automobile insurance, the companies offer the convenience of availing all services on mobile applications.

#2 – Evolution of Insurtech

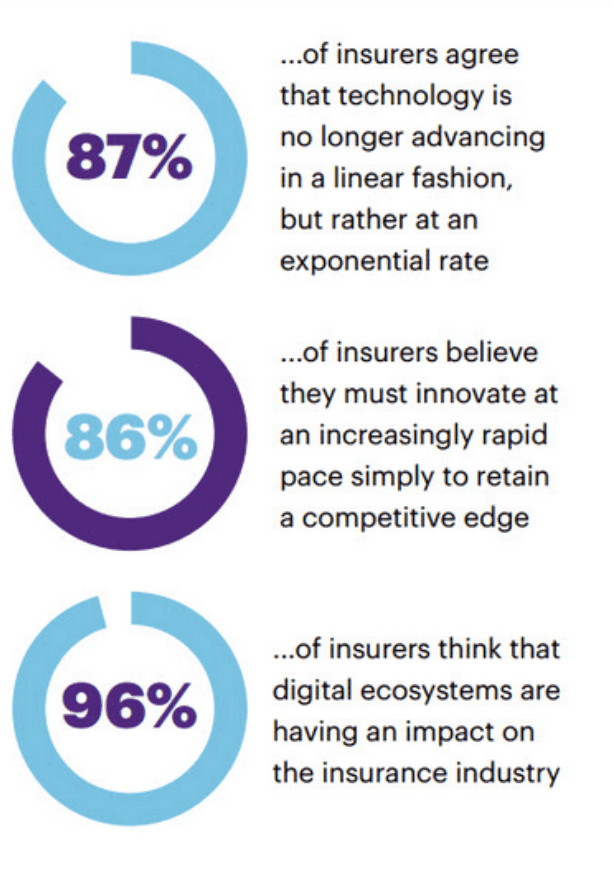

- As technology continues to expand itself into our daily lives, it is imperative that the insurance industry also makes the best use of it. With the onset of insurtech, the insurance ecosystem is witnessing a gradual revolution in its functioning.

- Largely inspired by the FinTech revolution, this epoch of digital transformation in insurance is centralized on data. With the employment of smart technology, the insurtech industry generates data pertaining to the consumers. This data is then used to create real-time insurance solutions that are not only customer-oriented but also beneficial for the insurers.

- With insurance tech, lengthy paperwork and documentation are completely eliminated. Digitization has brought insurance at your fingertips with mobile apps to avail the insurers’ services and maintain communication.

#3 – Need for Smart Technology

- The insurance sector with its traditional framework and outdated functionality has been rendered inefficient in the face of increasing demands and innovative tech.

- A number of start-ups have collectively brought about a disruption in the insurance industry by capitalizing on innovative technology. But a stronger force behind the rise of insurtech is the consumers’ demand for a shift from hefty paperwork and never-ending response time to a smooth and convenient process of insurance.

- On top of making the insurance process easier and faster, insurtech companies have also enhanced proficiency and cost-effectiveness. Big data has computerized quotes and claims, enabling faster decisions and responses. Artificial intelligence has enhanced customer communication while IoT devices facilitate improved data analysis.

Source: Accenture

#4 – Popular Insurtech Startups

Despite their relatively new entry in the market, insurtech start-ups have already claimed heavy investments and established a customer base. Some of the popular startups in the field are as follows:

- Everledger: With its foundation in 2015, Everledger has established itself as a reliable insurer against jewellery fraud. Its system employs the blockchain technology along with smart contracts to eliminate fraud claims.

- Metromile: Based in San Francisco, this startup provides auto insurance to consumers driving less than 5,000 miles in a year. It has its own wireless device named Metromile Pulse that measures the mileage. Its driving app helps users avail and manage their insurance claims on a phone.

- Oscar Health: In its mission to revolutionize the healthcare insurance sector, Oscar Health offers insurance services and medical assistance via its online portal and mobile app.

- Trov: This UK-based insurtech startup provides property insurance and management via its mobile app with features like real-time chat.

The advent of insurtech is effectuating a tech revolution in the current insurance setting, filling the voids of an outdated framework with smart technology. Insurtech has its own challenges to address in terms of validating its reliability as virtual insurers. But the ease and efficiency that it brings to the process can certainly give it an edge over traditional insurers.