Google wallet is like one of those strategies that appears to have extraordinary potential, but fails completely on execution. In its embryonic stage in 2011, Google Wallet promised a secure and brilliant replacement of hard cash in the form of digitalized money. It’s 2014 – where is Google Wallet now?

Google Wallet had been crafted to store debit, credit, loyalty as well as gift cards, so it could be used as and when required by the customer, without having to actually carry plastic cards. The vision, was to upload bank information to a virtual mobile phone wallet for transactions. These transactions would be made through a google account. Money would be available only a few taps away.

How Google Wallet Worked

- Integrating the phone with a near field communication (NFC) chip, payments could be easily made at the checkout, in the presence of a supportive terminal.

- The virtual wallet’s take on deals was also ingenious. If the user happened to qualify for a rebate, Google Wallet would automatically apply the coupon and adjust the final amount during the time of payment.

- Google also came up with the idea of a Google Wallet card that could be used where the option of tapping the phone to a terminal was not available.

- Google also provided the facility of making the customer aware of a discount in proximity. Naturally, the Google Wallet created quite a stir in the Android market. But it wasn’t meant to be. Soon after, everything went downhill for the application.

What went wrong?

The reason behind Google Wallet not hitting it off with the masses was not entirely due to Google’s ineptitude. However, short sightedness and overlooked loopholes contributed to its unpopularity.

- Distribution discrepancy – Initially, Google Wallet was only available to the Samsung Nexus S users. Installed with the NFC chip necessary for Google wallet to function, only people who owned this device had the opportunity to use the application. Slowly, over the years other companies started manufacturing their phones with the in-built NFC chip. Even then, NFC penetration has never been stellar.

- Rivals – The makers of ISIS (no, not the terrorist organisation), another mobile payment option started giving Google Wallet tough competition on being backed by AT&T, T-Mobile as well as Verzion. These carriers blocked Wallet on their devices, limiting its scope. Credit card companies like Visa and PayPal had their own interests to safeguard. MasterCard was the only saving grace for Google Wallet.

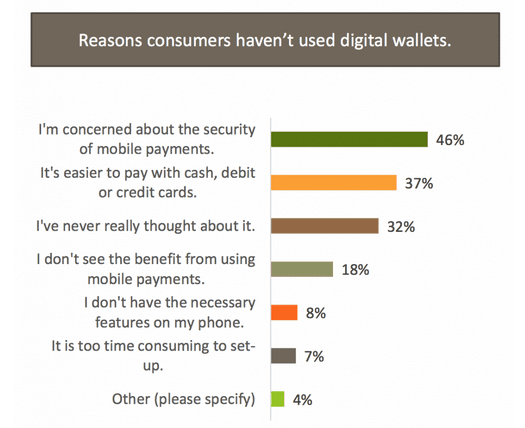

- Lack of awareness – Long after its launch, most people had no idea about what Google Wallet actually entailed. Online transaction had variegated meanings for people. Moreover, Google was so caught up with bug fixing and other technical issues, it never really paid much attention over the promotion of Google Wallet. Something Apple scored full As at.

- Security breach – Firstly, it is extremely difficult to earn the audience’s trust when its about getting them to subscribe to digital financial transactions. When the security of Google Wallet was compromised twice, users lost faith. A rooted Android device provided easy access to the information in the wallet, making it a cake walk for the hacker to break through the four digit pin code. Another example of incompetency in security was how all the files could be erased from the wallet account, followed by the setting up of a new pass key. In both these cases, hackers had complete power to rip off a user of his money. Unacceptable.

Here’s What Apple Pay Got Right

Apple didn’t have any of these blemishes to its Apple Pay service. Instead, Apple did the exact opposite, and pulled off a huge win.

1) Google Wallet had been introduced even before Apple Pay came into vogue. Using the same NFC technology like Google, Apple created a sense of necessity among users for mobile payment, which Google failed to do. Otherwise, there was no reason for Apple Pay to become a booming success, whereas Google Wallet, equipped with similar features became obsolete.

2) Ease of Use – A second disadvantage for Google Wallet was that users had to tap their phones as well as enter a pin code. Apple Pay customers only had to swipe their phones acrosss a terminal.

3) Sense of Security – Apple does not store any payment information except for recent transactions. Google, on the other hand, saves all the history of transaction details. This obviously may or may not sit well with its users.

To sum it up, it would be safe to say that Google Wallet was not a self-sufficient endeavor. It relied on a lot of external agents to function successfully. No wonder it failed to leave its mark. It’s probably time to big it goodbye.

What do you think of Google Wallet? Can it bounce back after falling so deep into this abyss? Let us know in the comments below!