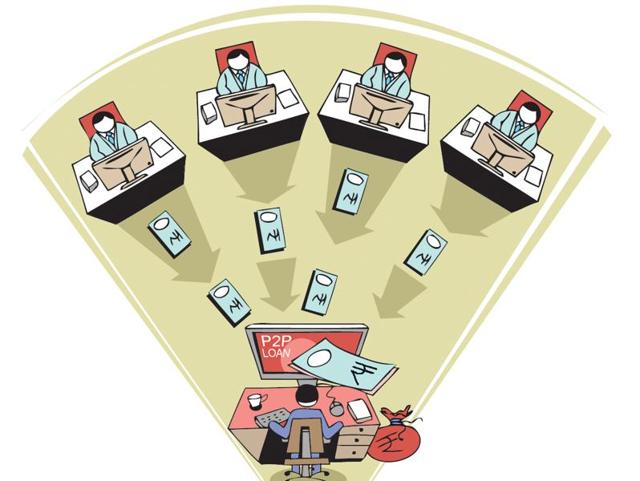

Innovations in Indian banking sector have been on a steady rise with multiple tech interventions. While complete robotization of the industry is imminent, alternate routes to access banking services also abound. One such new path to procure loans is Faircent’s P2P (Peer-to-peer) lending model. This model uses online portals to facilitate the process of loan.

In India, formal loans are accessible only to 10% of the total population. As a result of such low numbers involved in rotation, borrowers pay high rates of interest. Moreover, many customers scramble to mobilize funds because of the failure to meet set employment credentials, salary requirements etc. Correspondingly, such turn of events has led Indians to rely on unconventional modes of financing such as P2P.

Also Read: India Cashless: The Challenges & Opportunities

What does Faircent do?

Faircent was founded in 2013 by Rajat Gandhi, Vinay Matthews and Nitin Gupta. It’s a peer to peer lending service, providing borrowers and lenders an interface to allow for credit transactions to take place. Borrowers and lenders watch out for lower rates of interest and higher amount of returns, respectively.

Here, they come together to decide on a mutually agreeable interest rate. With this attractive prospective, Faircent has claimed to have processed loans worth 30 crores within 4 years of its initiation. As an effort to lower delinquency, a penalty is levied on the borrowers.

Notably, P2P has outdated the necessity for tête-à-tête interaction. It has, additionally, managed to get bankrolls from some biggies in the industry like BCCL, JM Financial Products, M&S Partners etc.

Registration

Borrowers pay a one-time registration fee of 500 rupees during registration. Faircent demands that the borrower links his/her bank account to gain access to borrower’s previous bank statements. On refusal of the required linkage, Faircent charges an additional fee of 500 rupees. It refunds an amount of 1000 rupees on the rejection of an application. On the other hand, the lenders pledge 1% of the total capital they are going to invest.

Working model

Demonetization was the ultimate clarion call for financing industries to come up with innovative, alternative business models to stay afloat. Faircent’s P2P lending model seamlessly adapts with the current technology. This technology-driven model increases the efficiency of transactions.

Defying reality, Faircent’s P2P lending follows reverse auction lending. The lender’s dashboard lists potential registered borrowers with an information displaying the required loan. In this setup, lenders bid for the borrowers’ proposed sum of the loan. The lenders respond to the borrowers’ profiles by sending across proposals. Now, it is up to the borrower to accept or reject the offer. On acceptance, the Faircent team gets in touch with the lender. After the mutual agreement, both the parties digitally sign a formal contract to legalize and re-confirm the negotiation.

A lender can fund only up to 20% of the stipulated loan. This mandates that the borrowers borrow from multiple lenders at to complete their requirement.

Another key point is that the lenders select a borrower belonging to either of the categories – high, medium or low-risk (higher the risk, higher the interest). In addition to the already extant filters such as the six months’ bank statement, salary and tax statements, lenders, too, add their filters such as job stability, declaration of permanent address to the criteria

Also Read: What Happened to Google Wallet?

Partnerships and services

Faircent has collaborated with many corporations to render a motley mix of services to its clients and enable smooth functioning.

In partnership with eMudhra, it houses the facility of digital signing contracts. Second, Yodlee syncs multiple bank accounts with site’s loan accounts and credit accounts. Third, Lendo aids in calculating social scores of the borrowers by taking into consideration one’s followers, friends, and postings on social networks. Finally, Jocata is instrumental in seeking income tax details.

Managing risks

The firm undertakes a lengthy process of authentication to mitigate risks in the platform. Using the TransUnion, the site results in the potential borrowers based on a comprehensive study on numerous identity points, data, and metrics. Thus, it exterminates the need for physical documents. TransUnion sifts through both financial and personal data to calibrate the risk of both borrowers and lenders. Personal data are fetched from sites like Facebook, Twitters, Linkedin etc. A rounded picture of their financial past is also corroborated by their financial statements. It rejects or accepts the profile based on built-in algorithms. This task of screening requires syncing of the clients’ bank and credit accounts with the site. Such perusal, effectively, betters the quality of loans advertised and increases security.

New developments

A while ago, Faircent collaborated with Mumbai-based bike taxi service Baxi to provide two-wheeler loans. It has also introduced trade loans to distributors and retailers of consumerable products.

Also Read: When will smartphones replace credit cards?

Regulations

Faircent’s regulations

The registered users are expected to be of more than or equal to 25 years of age. Further, the company recommends that the lenders’ salary should be 10 lakhs per annum or move. Mandatorily, they should have a valid bank account. Most importantly, Faircent only facilitates the process. It acts as a detached mediator who doesn’t impinge on the decisions of the users by providing ratings or suggestions.

RBI’s regulations

The Banking Regulation Act of 1949 requires all banks to be supervised and regulated by the RBI. Mainly, it vests the RBI with the power of licensing banks, issue penalties, frame instructions for audits etc.To prevent any financial disruptions, RBI has recommended regulations for P2P Lending platforms. Though there has been no official institutionalization of regulations, RBI has published a consultation paper on Peer to Peer Lending in April 2016, inviting comments from the public.

RBI has proposed several regulations on P2P lending companies as follows: They should register as non-banking financial companies (NBFCs). P2P’s role must not exceed simply providing a common place for the clients. Funds must flow fluidly from the lender’s account to the borrower’s account. The headquarters of the firms should function in India. Also, regular submissions of reports to RBI are necessitated. The firms, per se, must possess a minimum capital of 2 crores. Still, the report kept away from imposing any restriction on amount and rate of lending.

Analytic report, 2016

To gain public trust, Faircent transparently published an annual industry report in 2016. The following observations featured in it: Married borrowers are preferred more than single borrowers for funding. Self-employed professionals like doctors, engineers etc. are more likely to procure funds than those with self-employed business. Borrowers have high possibilities of funding family events than for purchases of appliances and two-wheelers. Nonetheless, repayment of loans taken for appliances and two-wheelers were timelier. About 60% of the population on the platform are below the age of 35, with a significant segment under 30.

Challenges

Despite a watertight model, several loopholes are too glaring to be avoided.

The basic challenge to tackle is the lack of awareness and acceptability among Indians who find utter credibility in traditional banking.

The startup streamlines the unwieldy process of transactions for both the lenders and borrowers. Yet, it is inevitable that the lenders might find their investments more jeopardized than the borrowers who are at the receiving end of the transfer. In a traditional system, banks disburse loans to the borrowers with the insurance of collateral pledged by them. P2P lending defines this framework by doling out unsecured loans. This only increases the chances of deprivation of lenders’ invested capital. At times, the borrowers are, equally, disadvantaged if their calculated rate of risk resulting from data analysis is high. This leads to upping of interest rates.

Finally, a major setback is the low internet penetration in India. World Bank reported in 2015 that only 26% of the population have access to internet. Therefore, for the time being, low internet penetration limits the scope of an initiative like P2P which relies entirely on that facility.

Also Read: Digital Payments Are Influencing Consumerism In A Big Way

A reflection on present and future

The digital revolution in countries like the UK, US and China has made it easier for fintech firms to fan out their wings hassle-free. While India steadily increases its technological horizons, in comparison with the former countries, it is still in its embryonic stage. Having only around 30 P2P lending firms, India pales in comparison with China which houses more than 2000 such financing platforms.

Alongside such an online provision, it is prudent to reach out to those inaccessible through traditional bricks and mortar firms such as MicroGraam, Rang De, Milaap etc. These firms enable potential people to lend to those living in penury in exchange of a low-cost interest. With such a dual approach (online and offline), many more lenders are encouraged to benefit by lending to the loan ecosystem. Correspondingly, borrowers get a promising opportunity to develop their state of being. Thereby, both the lenders and the borrowers contribute to the development of the nation.